Picture this: you need knee surgery, but your local hospital says it'll cost more than your car. Then a friend tells you about a clinic in Thailand, where doctors are top-rated, and the whole deal—including a recovery vacation—costs less than half of what you’d pay at home. Tempting, right? Medical tourism isn’t a fantasy—it’s a booming reality. But there’s a catch that trips up even the savviest travelers: does your insurance plan have your back overseas, or are you gambling with your wallet?

What is Medical Tourism and Why Do People Choose It?

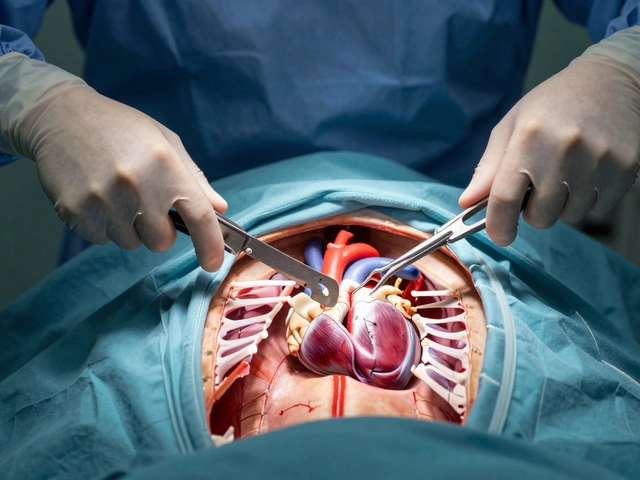

Medical tourism is when you travel to another country for medical care. It isn’t just about sun and sand—people cross borders for heart surgeries, dental implants, fertility treatments, and even complex surgeries they can't afford or easily access back home. The numbers are huge: According to Patients Beyond Borders, about 14-16 million people globally sought medical care overseas in 2024, and that’s only growing. The reasons are obvious: jaw-dropping price differences, shorter waitlists, and sometimes just better service or innovative treatments not available everywhere.

For example, a hip replacement in the US can set you back $32,000 on average, but the same operation might cost less than $10,000 in India, flight and hotel included. South Korea is a hotspot for cosmetic surgery, while Mexico sees thousands cross the border for dental work that often costs 75% less. People aren’t only chasing savings—they’re also after high-quality care, destination recovery, and privacy. Clinics woo international patients with seamless services: English-speaking staff, airport pickups, luxury rooms, and bundling hospital time with beach resorts. It all sounds dreamy…until you stop and think about that insurance question.

Here’s the rub: Just because you save money on the procedure doesn’t mean you’re out of the woods financially. Unexpected complications, missed flights due to extended recovery, and follow-up care can double or triple your costs—if you have to pay out-of-pocket. That’s why cracking the code on insurance coverage is so vital.

Does Insurance Cover Medical Tourism? The Fine Print Unpacked

So, does your insurance cover medical tourism? There’s no single answer because not all policies are created equal. Most standard health insurance plans in countries like the US, UK, or Australia do not cover planned treatments outside your home country. They expect you to stick with their network. You’re usually only covered for emergencies while abroad—like if you get hit by a scooter in Rome, not if you flew to Rome for that cheeky dental bridge.

Employer-sponsored plans usually play it safe, covering only emergency care when you’re traveling for work or vacations. They rarely pay for planned overseas surgery. Medicaid and Medicare in the US do not cover non-emergency care outside the States. And yes, lots of people get caught out by the restrictions written in the fine print or buried in long policy docs that nobody, let’s be honest, ever wants to read.

The landscape is changing, though. A growing number of specialist insurers are wising up to the trend. They’ve started offering policies just for medical travel, filling gaps regular insurance leaves wide open. Some big employers—even US state governments—are now testing overseas care options for pricey procedures, because it saves them big bucks. But unless you’ve bought a separate “international health insurance,” your everyday plan most likely isn’t built for medical tourism.

Check out this rough breakdown from insurance providers as of this year:

| This Type of Insurance | Does it cover medical tourism? | Typical Notes |

|---|---|---|

| Regular HMO or PPO | No (except true emergencies) | Network hospitals only; out-of-country elective procedures rarely covered |

| Medicare/Medicaid (US) | No | Only covers in the US, with rare global exceptions |

| International Health Insurance | Often yes | Designed for expats, travelers; elective overseas care possible |

| Travel Medical Insurance | Emergencies only | Won’t pay for planned procedures abroad |

| Specialist Medical Tourism Plan | Yes | Work with specific clinics/hotels, bundled with aftercare sometimes |

If your regular insurance does remotely cover treatment overseas, expect requirements: prior approval, use of partner clinics, maybe paperwork in triplicate. Always verify with your insurer directly before booking anything. Sometimes the most shocking bill isn’t from the doctor—but from your insurer declining to pay afterward.

Types of Insurance Policies for Medical Travelers

Let’s talk about the sort of policies out there for people serious about getting care abroad. If you want real peace of mind and don’t fancy playing medical roulette, you’ll want to think beyond your basic health coverage. Here’s how the big players look in 2025:

- International Health Insurance: Think of these as beefed-up regular policies for expats, long-term travelers, or digital nomads. They cover planned treatments almost anywhere, not just accidents or illnesses that strike after you land. Companies like Cigna Global and Allianz Care specialize here, wrapping in access to accredited foreign hospitals, translations, and even medical evacuation if something goes south.

- Medical Tourism Insurance: This is the new kid in town, tailored specifically for people jetting off for surgery or major procedures. These policies cover complications, extra hospital stays, cancellations, and sometimes botched work. Axa, IMG, and a bunch of boutique firms jumped into this arena recently. They often partner with top clinics in Mexico, Turkey, Thailand, and India. Some policies throw in hotel stays and a medical concierge.

- Travel Insurance with Medical Add-ons: Most travel insurance only kicks in for emergencies—think food poisoning, a snapped ankle, or, worst-case, a need for airlifting home. Some now offer what’s called ‘complicatons coverage’—if something goes wrong after planned surgery, they'll help with the fallout including hospital stays or extra travel costs, but not the original procedure itself.

- Employer-Sponsored Medical Tourism Plans: Big companies looking to trim healthcare costs sometimes contract with overseas hospitals for pricier surgeries. If your HR department is adventurous, you might see this pop up in your benefits soon. Walmart and Lowe’s in the US have dabbled in this model, and employee take-up is growing.

There’s also a rare hybrid: a handful of US insurance plans now allow you to get care abroad if you use their hand-picked network hospitals. This is still the exception, not the rule—but insiders say it's picking up steam.

What To Watch Out For: Exclusions, Risks, and Surprises

This whole thing sounds great in theory, but medical tourism is full of gotchas. Exclusions are everywhere. Travel insurance rarely covers you for “planned medical care” overseas. If you get a nose job in Istanbul and there’s a complication, don’t be shocked if your emergency policy says, “Sorry, this was scheduled—we’re out.”

Always read the fine print on exclusions. Many plans refuse to pay for:

- Cosmetic or elective procedures (nose jobs, veneers, liposuction—these are often excluded unless medically necessary)

- Experimental treatments or stem cell therapies

- Pre-existing conditions

- Follow-up care back home, especially if complications arise after you return

Another minefield: accreditation and licensing. Not every hospital abroad meets the same standards. The best safeguard is using hospitals accredited by international organizations like the Joint Commission International (JCI). If your insurer does work with foreign hospitals, they'll usually list their partners. Never assume your coverage works everywhere—sometimes insurers only cover “approved” clinics.

Let’s not forget legal hurdles. Medical malpractice laws differ wildly abroad. If something goes wrong, your ability to sue or get compensation is murky at best. Insurance will sometimes cover extra treatment or getting you home, but almost never pays damages for pain and suffering.

Here’s a reality check: Even in 2025, the single biggest factor in denied claims is poor communication or lack of paperwork. Keep every receipt, scan every doctor’s report, and email your insurer every step of the way. Anything less, and you risk headaches down the road.

Smart Tips Before You Book That Medical Trip Abroad

Done right, medical tourism can be life-changing, but don’t book that flight until you’ve ticked off some basics. Here’s how to give yourself the best shot at a smooth, covered experience.

- Contact your insurer first. Don't guess—ask in writing if your proposed treatment is covered, and get the answer documented. If not, ask them to recommend any medical tourism partner plans or international coverage.

- Look up accreditation. Make sure your chosen clinic is recognized by a group like JCI or, in Europe, the International Society for Quality in Health Care (ISQua). The best hospitals flash those badges proudly. If they hide it, that’s a red flag.

- Get a quote for total travel, procedure, and aftercare costs. Surprise expenses like extra nights in recovery, prescription drugs, or complicated flights can wipe out your savings. Ask for an itemized bill upfront.

- Consider medical complications insurance. If your regular insurer won’t touch overseas care, buy a short-term policy from a medical tourism underwriter. This protects you in case you need a second procedure or extended hotel stays after complications.

- Don’t skimp on research. Read patient reviews, ask about language barriers, assess risk of infection, and don’t forget about blood safety—especially for surgeries. Some countries have higher risks for blood-borne infections.

- Set up aftercare at home. Make sure your own doctor is willing to take over post-op monitoring. Many will, but some hesitate to treat a complication from another clinic.

- Double-check visa requirements. Some medical visas are longer or need extra paperwork. Don’t get stranded or fined over a technicality.

- Save everything—literally every receipt. You'll probably need to submit piles of paperwork to make an insurance claim or even for tax purposes.

- Be realistic about the risks. Even the best hospitals abroad have some risks you might not face at home: infections, miscommunication, or different standards. Know the odds and balance the risk versus reward.

- Understand your legal position. If things go bad, your protections might be weaker than you're used to at home. Insurance softens the blow but rarely makes you whole for long-term complications.

Remember, the world of medical tourism isn’t wild or lawless anymore, but it’s not one-size-fits-all either. Each case is unique, and policies shift as more people chase passport-powered healthcare. The savviest travelers make sure every duck is in a row before they leave the runway.

The rise of medical tourism is rewriting how—and where—we get care. But without proper insurance, that dream treatment abroad could become a financial disaster. Go in with your eyes wide open, ask the awkward questions, and snag the right coverage—or keep your international adventure as a holiday, not a hospital stay.